The United States, the world market that most increases its wine imports

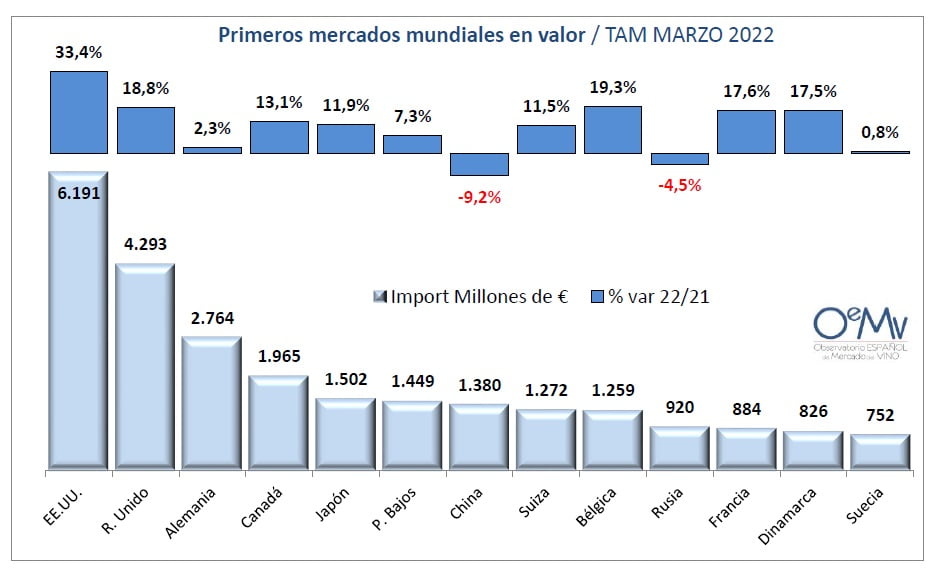

The 13 main world wine markets, according to the recent report of the Spanish Wine Market Observatory, accounted for around 71% of both the value and the total volume of world wine imports made in the year-on-year to March 2022, with 7,796.9 million liters (+1.4%) and 25,457.3 million € (+14.3%). Both in litres and in euros, they grew less than the world average which, as we have seen, was +4.8% in volume and +17.8% in value.

In absolute terms, the purchases of these 13 analysed markets grew by 108.3 million litres and by 3,192.7 million €. Their average price increased by 12.8%, to 3.27 €/litre (+37 cents). In this case, it increases slightly above the world average (+12.4%), which stood at €3.23/litre.

In the ranking of major world wine importers, several changes have occurred in this year-on-year period (12 months to March of ’21). In terms of value, China falls to seventh position, being overtaken by Japan and the Netherlands. Japan, in turn, surpasses the Netherlands, occupying fifth and sixth place, respectively.

On the other hand, Denmark surpasses Sweden in the twelfth position, registering an increase of +17.5%, by one of the Swedish country, of +0.8%.

In terms of volume, the United States surpasses the United Kingdom, and becomes the world’s second buyer of wine, after Germany, with an increase of +16.8%, due to a fall in the British market of -3.5%.

On the other hand, Belgium surpasses Russia in eighth position, increasing by +6.7%, due to a fall in the Russian market of -9.5%.

Similarly, Italy surpasses Portugal, Japan and Sweden and is ranked tenth, being the market that most increased its wine purchases in percentage terms (+55.5%), up to 300.7 million liters (+107.3 million liters), mostly bulk wine.

The United States remains the world’s leading market for wine imports in terms of value, moving away from the United Kingdom, the second market, after registering a growth of 33%. In terms of volume, it ranks second, after Germany and surpassing the United Kingdom. In the year-on-year to March 2022, the United States acquired wines for a record amount of 6,191 million €, surpassing the €6 billion barrier. Compared to the year-on-year to March 2021, it increased its expenditure by 1,550.3 million € (+33%), distancing itself from 4,292,€6 million from the UK (+18.8%). In terms of volume, it imported 1,409.7 million liters and increased by +16.8%, already close to the 1,416.7 million liters of Germany (-3.2%). Its average price stood at 4.39 €/liter, a +14% higher or 55 cents above the average price recorded in the year-on-year to March 2021.

The United Kingdom remains the second world investor in wines with € 4,296.6 million (+18.8% or 680.7 million more) and third in terms of volume, with 1,354 million litres and a fall of -3.5%.

Germany, which reduced the volume acquired by -3.2%, manages to remain the world’s largest importer of wine by volume, with 1,416.7 million litres. It spent +2.3% more, up to €2,763.8 million, increasing its average price by +5.7%, to €1.95/litre.

Canada consolidates as the 4th largest world market in euros, with an investment of €1,964.7 million and growth of 13%, although it is still 6th in the ranking in volume by the purchase of 415.4 million liters (-7.6%). This difference between positioning in value and volume gives an idea of its average price, higher than in many other markets, which stands at €4.73/liter year-on-year as of March 2022, with an increase of 22%.

China, for its part, is the market among the main that has fallen the most in value in this period, when it stopped spending 139.8 million € (-9%). It also recorded losses in terms of volume in the year-on-year to March 2022 (-3%), lower in value terms, as its average price fell by -6.4%, up to 3.45 €/liter. It was the only market among the 13 analysed which reduced its average purchase price in this period.

Russia was, along with China, the only market that fell in value terms (-4.5% or 43.4 million €), to 919.7 million €. It also recorded losses in terms of volume (-9.5%), up to 322.1 million litres, which is 33.9 million litres less.

SOURCE: AGRONEWSCASTILLAYLEON.COM